Table of Contents

What is Margin Trading in Share Market: Risks and Advantages

Hello, Friends Today we will learn About What is Margin Trading in Share Market: Risks and Advantages.

It’s Risks and Advantages, Leverage/Exposure, margin money, etc.

What is Margin Trading in the Share Market?

Market Exposure is one type of Virtual digital money loan.

This loan provided by Broker Companies. But this loan system totally different from Banking Loan. On stock market language this type of loan called Exposure. somebody called margin or Leverage.

We’ve talked about that in the last few days.

- What is the stock market, how it works?

- Advantages and disadvantages of the stock market.

- The Share market can be divided into how many parts and what.

- IPO & Mutual Fund

- What is meant by Technical analysis?

- What is a Trading cycle?

- Video on how to trade shares through Upstox Etc.

- Margin Trading Meaning

If you have difficulty understanding any of these eight topics, please let us know.

Table Content

Introduction

What is Margin Trading in Share Market: Risks and Advantages

Stock Exposure Working process

Rules of margin trading

How much you get Exposure to Broker companies?

Leverage on Delivery trading

how to enable Stock market Exposure?

Advantage & Disadvantage of Exposure

Brokerage Calculator.

My Opinion

Margin Trading Facility

Just think you have invested 10k Money on the stock market. You want to buy Cesc stock at 800 prices, as your Invest money, you will buy 10000/800= Near 12 Qty share. Now if you want to buy more Qty Stocks within 10k (your investment money) then you can apply for a loan or Exposure to a Broker Company.

As an example, you have invested 10k money & can get 10 -20 time exposure.

20-time exposures mean 20 compound loans.

10k(own invest) * 20 (broker company exposures)

Total – 2lakhs share you can buy.

If you invest 1000 rupees, you can get 20000 rupees, So now you get 20-time extra money & also you can buy lots of shares.

Join Our WhatsApp Group & Get Free

Intraday Calls

******************************************************************************************************************************************************************************************************

Join Our Telegram Group & Get Free

Intraday Calls

How much you get Exposure to Broker companies?

Exposure limits are depending on the Stock category, Market volatility & Brokerage companies.

Market volatility means especially Election result day, China vs. India border problem Issue, Govt. Budget releasing days, etc. On that day’s Broker company decrease Stock Exposure.

And also remember don’t trade on this special day Market volatility is dangerous for trading.

Most of the broker companies give High Exposure limit, like-

- Zerodha Margin – 20 Times

- UPSTOX Margin – 20 Times

- 5PAISA Margin – 20 Times

- ANGEL Margin – 30 Times

- Icicidirect Margin Trading Example 30 Times

Rules of Market Exposure

If you think using broker Exposure money you will earn unlimited money that is totally wrong. It’s too risky because…

Rules No1.

You never Withdrawal Exposure money, you just Withdrawal your own money that you have a deposit on your Demat account.

Rules No2. You don’t have to pay any interest for Exposure money, but intraday brokerage charges will be deducted. As a simple brokerage per lakh brokerage, 100/- rupees will be charged.

If you open a Demat account with us, and then the brokerage amount will be deducted only 85-90 Rupees per lakh.

Rules No 3. Exposure Limit is applicable for Intraday Trading. Don’t forget it. On delivery trading, you cannot get any type of Exposure Limit.

Intraday means within a day. If you buy a stock today and sell it today, it is intraday trading.

And delivery means that if you hold a stock for more than one day, that is, after 24 hours, the stock transfer to the delivery position.

For details Information of Margin Trading Facility.

Now problem is that within 3.10 pm you have to refund the loan or exposure amount whether you are in profit or in loss.

Think your investment is 10000/-

Now you have purchased TCS share (example) on Intraday Position.(using 20-time exposure)

Buy rate – 1250/-

Using 20-time exposure means – 10000*20 time exposure -200000/-

Now you have purchased TCS share 200000/1250= 160@qty.

If you using your own money, the maximum qty will be – 8@qty.

So that is a major difference, using exposure you can buy lots of qty.

If TCS share moves 1250 to 1260, that means you get per share 10Rs.

Total profit – 160@qty * 10 = 1600/- using exposure limit.

Without exposure your Total profit – 16@qty * 10 = 160/-

Now think the opposite, within 3.10 pm if TCS share fall 1250 to 1240 that means you lose per share 10Rs.

Total loss – 160@qty * 10 = 1600 + brokerage.

That why is very risky.

Intraday is very popular in the stock market.

Everyone likes it and they think possible to earn a lot of money in a very short time and in very little money.

But it is a very risky game, those who have a lot of experience and those who have a lot of practice; are making a lot of money from intraday trading.

But since you are not going to do it now, there may be losses. 80% of Traders lose money on intraday trading.

Leverage on Delivery Trading

Yet some broker companies are providing Exposure limit on Delivery Position.

Ventura, Angel, HDFC, etc are providing 5-10 times the Exposure limit on Delivery Position for 7 days.

In that case, the brokerage is too high; you have to pay brokerage per day.

Most of the trader uses this facility on BTST

Buy today Sell tomorrow

For detailed information on BTST, click here-

Yet BTST trading is stopped by SEBI.

How to enable Stock market Exposure?

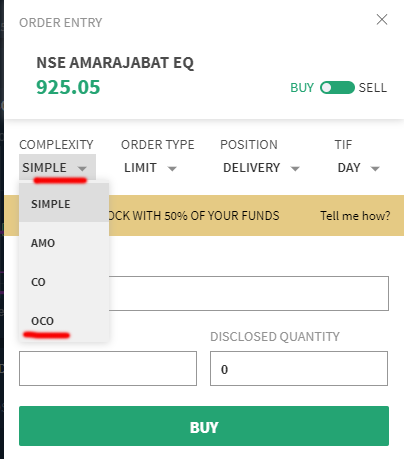

The exposure applying system is very simple. you can get the enable option on the trading platform or broker mobile application.

when you click stock to buy, there you get 4 option on complexity

Simple

AMO

CO

OCO

You have to select OCO for exposure /margin & you can get 20 times leverage to buy stock.

Advantage & Disadvantage of Exposure

Advantage of Exposure

- Huge money Earning scope on Intraday Trading.

- The best opportunity to the small trader for trading, because they invest low amount & using leverage

- Always Delivery brokerage is high compare to intraday trading, on this side intraday trading brokerage is too low.

- The extra benefits of intraday trading are time savings.

The disadvantage of Exposure.

- For new trader intraday trading is too risky, If the new trader chooses intraday trading & use exposure, then I am 100% sure, he will lose 90% of the money.

- Stock holding facility is not applicable to intraday trading. before 3.15 pm you have to square off your position.

- Without technical analysis & practice, intraday trading is highly dangerous.

- So my recommendation is to ignore intraday trading & don’t use exposure without experience.

Brokerage Calculator.

You can see my Brokerage Calculator-related video.

Remembering Words

The above are a few ways through which you can learn What is Margin Trading in Share Market: Risks and Advantages. To learn more about intraday trading, you can consider joining the Nifty Bazar Course. With us, you can learn free technical analysis and the art of chart reading. We will help you in not only becoming successful intraday traders but also successful investors. To know more about us, you can contact us via email or phone. We will be glad to serve you.

Read Upstox Margin Trading Facility

Join Our WhatsApp Group & Get Free

Intraday Calls

******************************************************************************************************************************************************************************************************

Join Our Telegram Group & Get Free

Intraday Calls