Table of Contents

What is Primary Market?- Deference between Primary vs Secondary Market Details Explained.

Hello Friends in this Article we’re gonna discuss the very basics of the Primary vs Secondary Market. What is Primary Market?- Deference between Primary vs Secondary Market Details Explained

Introduction:-

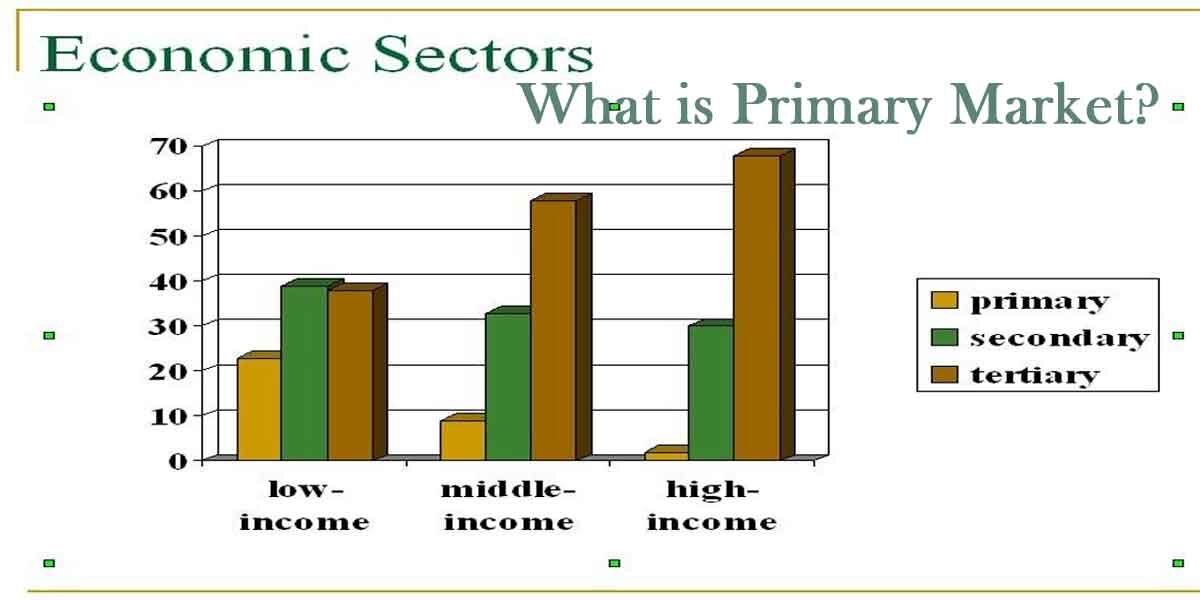

How they are set up and where the money goes when someone buys or sells a stock. so the term market is exactly what you may think of it’s a place where buyers and sellers meet to exchange goods. But instead of buying cereal or fruit like at your local market in the financial markets, people and institutions buy stocks bonds, funds currencies, or derivatives like options.

Broadly speaking these types of products are called securities, having this type of market structure is useful. As it provides transparency and allows for regulations on trading, allows for the pricing of securities to be driven by supply and demand.

Ultimately leading to improved efficiency of the markets now the capital markets can be broadly defined as the stock and bond markets. In these markets government agencies public companies and private companies can all sell securities to try to raise capital perhaps a municipality requires.

Join Our WhatsApp Group & Get Free

Intraday Calls

******************************************************************************************************************************************************************************************************

Join Our Telegram Group & Get Free

Intraday Calls

Capital to finance a piece of infrastructure like a parking garage. While this municipality may elect to issue a municipal bond to raise the necessary capital, a similar scenario may be true for a public or private company that wants to raise capital by issuing a bond or perhaps ownership in their company.

Often called stock or equity now let’s imagines that a private company is going to issue the stock for the first time well. They do so on what is called the primary market.

The primary market is where securities are sold directly from the issuer to investors in this example the company is the issuer the primary market is with securities like stocks and bonds.

First, become available this initial sale is often called an initial public offering or IPO for short now generally institutions like investment banks endowments mutual funds hedge funds pension funds insurance companies.

What is a Secondary Market & a Primary market?

The essential market is the place where protections are made, while the optional market is the place where those protections are exchanged by financial backers. In the essential market, organizations offer new stocks and securities to general society interestingly, for example, with the first sale of stock (IPO)

And so on are the only players in the primary markets usually individual investors don’t get to participate in the primary market. The secondary market on the other hand which you may often hear called the stock market.

The NSE is a good example of a secondary market, while the secondary market has many individuals participating in it. When stocks and bonds are sold the issuer receives no additional capital as they do in the primary market, in fact, the key distinction between the two markets is that in the primary market. The issue of sells securities and they receive the capital and in the secondary market, securities are bought and sold to and from other investors. So if an investor buys shares of a company through the secondary market they are buying those shares from another investor therefore it is ultimately supply and demand for individual shares.

That drives the price of anyone’s security well if there are more buyers relative to sellers while the price of the security will move higher and the opposite is true. The key differences between the primary and the secondary markets.

Difference between Primary and Secondary market

Secondary Market

Also called as – After Issue Market (AIM)

Role of the market – Market where stocks are exchanged once gave

Intermediaries – Brokers

Sale of securities – Sold and bought among financial backers and merchants

Price of shares – Changes relying upon the market interest of offers

Primary Market

Also called as – New Issue Market (NIM)

Role of the market – A market where stocks are given interestingly

Intermediaries – Investment banks

Sale of securities – Directly by companies to investors

Price of shares – Fixed at par value

Some useful Articles

Best Way to Learn Stock Market in India

What is Margin Trading in Share Market: Risks and Advantages

My Word

if you have any questions about the Secondary market the world of investing any suggestions on the Article please post in the comments below and please share this article continue with your friends.